Services Offered

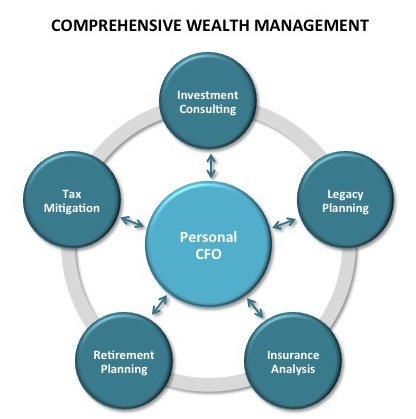

Our name, Orchard, was chosen to help convey our long-term commitment to your financial future. As such, we offer access to comprehensive wealth management, where all the services employed in your overall strategy are incorporated into a singular, yet dynamic, focus. No matter which combination of services you ultimately use, we always take a holistic approach and do a very deep dive to understand your personal viewpoints and review all your financial holdings. Investors like you, who choose to engage in a relationship with us, should keep an outlook of patience, discipline, and consistency. We are, after all, growing an orchard! We hope to one day live off the fruit it bears, so the intention should never be to cut off the limbs for firewood during a cold spell. Of course, your personal situation is ever-changing; therefore, we periodically reassess your progress and adjust course as needed. The various disciplines we offer within comprehensive wealth management are:

Investment Consulting: As a small, independent firm with no allegiance to any particular funds or investments, we are consistently able to provide unbiased investment advice. Our approach is custom-tailored to your income needs, current holdings, time horizon, risk tolerance, constraints, liquidity needs, legacy impact, tax considerations and end-goals. It is a considerable amount to review, but the end-result of engaging in such a thorough process is that we help ensure a truly holistic evaluation of your investment accounts. Only then do we begin to construct your customized model, employing a suitable variety of investment vehicles. These include but are not limited to individual stocks, preferred stocks, real estate investment trusts (REITs), individual bonds, individual municipal bonds, exchange-traded funds (ETFs), and closed-end funds.

Legacy Planning: This is probably one of the most complex and daunting challenges facing investors, due to myriad changing laws and shifting global markets. We use a multi-generational planning approach that focuses on smoother transitions of wealth, with less family discord, and an effective transition of family values and leadership. We form a strong partnership with an estate attorney—either your pre-existing relationship or the one we help you establish. Together we carefully craft the legal framework that helps ensure your legacy's continuation (as an individual, family, charity and/or business owner) long after your passing. We also discuss the steps you should take with each of your assets and how we'll manage the funding process. The various aspects of legacy planning that we oversee are estate plans and trusts, intergenerational wealth transfer, life insurance, and tax-favored accounts. The mix of assets we use for this type of portfolio is considerably different than what you may be familiar with, and this is because the vast majority of advisors only develop financial plans for your own lifetime. Family names like Kennedy, Rockefeller, and DuPont are memorable because they have been able to effectively transition their wealth to multiple generations, while not endangering the originating benefactor's gift. We have proudly defended and preserved our clients' legacies for decades and offer these same services to you.

Insurance Analysis: For this important aspect of the comprehensive wealth management mix, we review the analysis previously performed in order to recommend the appropriate insurance protection strategies. For our High Net Worth families, in conjunction with your accountant, we identify if additional insurance is recommended, such as an Irrevocable Life Insurance Trust (ILIT) or Second-to-Die policy. Orchard has access to many of the industry's top recognized providers.

Retirement Income Planning: Retirement is a time of significant change, both to your lifestyle and finances. Far too often, retirees suddenly find themselves needing to turn to consistent income sources (e.g., investments, pensions, and social security) for support. Since you may not be in the same life-stage or have the same amount of assets as another client, sometimes these conversations also include savings strategies, retirement spending targets, and business liquidation strategies. Orchard works with you in an ongoing process that takes into account your continually evolving goals, expenses, projections, tax situation, and risks. We allocate the assets in your qualified plans accordingly so as to protect those sources of support for years to come. Whatever stage you are in, our objective is to help you achieve the most financially comfortable, worry-free retirement possible.

Tax Mitigation: In an environment of complicated and ever-changing tax laws and rates, employing a tax-integrated approach to comprehensive wealth management is critically important. We coordinate with your existing tax advisor or offer you recommendations for one if you don't already have one, in order to maximize your after-tax results. Ultimately, we seek to make sure you pay the least amount in taxes by controlling when you buy and sell assets.

Tax Mitigation: In an environment of complicated and ever-changing tax laws and rates, employing a tax-integrated approach to comprehensive wealth management is critically important. We coordinate with your existing tax advisor or offer you recommendations for one if you don't already have one, in order to maximize your after-tax results. Ultimately, we seek to make sure you pay the least amount in taxes by controlling when you buy and sell assets.Personal CFO: Similar to the role of a corporate CFO, a personal CFO provides ongoing management and integration of your financial affairs and wealth strategies in two ways. First, we take a very active role in engaging our various outside professionals in your plan. Then we lead and oversee their execution of the recommended strategies. Second, on a more personal level, we act as a sounding board when you are facing major financial and life event decisions. Here are some examples of the questions you may be seeking advice for from us: Would now be a good time to refinance my home? As a recent widower, can you help me wrap my head around the finances that my husband once handled? How would I be impacted if I decided to put my business up for sale? What steps should I take to protect myself financially, since learning my spouse is terminally ill? Can I afford a vacation home? Should I purchase or lease my next car? Will I be able to financially support my aging parents? Your Personal CFO, as a value-added service of your fee-based account, is both a separate and integrated service. It weaves into each comprehensive wealth management service we offer and yet also stands apart when needed. We've made it our business to understand your life, your entire financial picture, and your end-goals—so we encourage you to turn to us early and often.